Connecting Apps, People and Banks

Connecting Apps, People and Banks

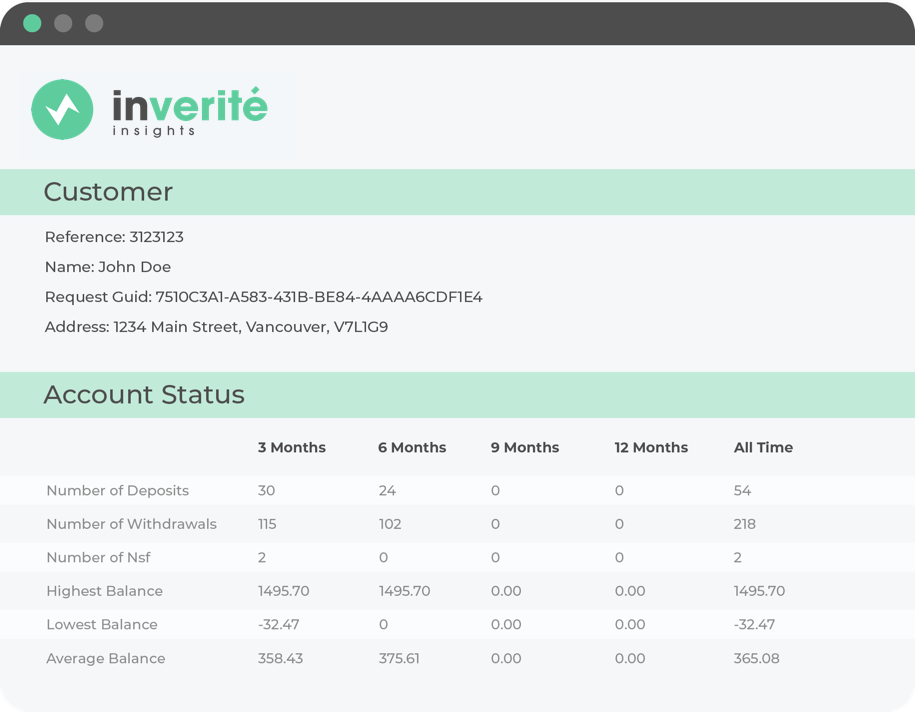

With support from over 280 Canadian Financial Institutions, Inverite is the clear market leader in Instant Bank Verification. Quickly, easily and securely connect your users’ financial data to your business regardless of whether you are a personal finance app, online lender, or money service business.

Features

Access full account, transit, and institution numbers from over 280 Canadian financial institutions

- Access transaction history from over 280 Canadian banks and credit unions.

- Flexible reporting length for up to 365 days.

- Categorize and summarize transactions.

- Access account owner’s name, address, and contact information.

Choose integrations through API, iFrame, and the Inverite platform for tailored requirements.

Benefits

Get the most comprehensive view of users’ financial data in one place.

Gain valuable insights into user spending habits and improve financial decision-making.

- Eliminate potential transaction fraud in lending.

Ensure highly accurate verification to reduce the risk of rejected transactions due to incorrect information.

Reduce the risk of NSF fees by verifying the availability of funds.

Experience fast and reliable verification.