The Future of Risk Analysis Is Here

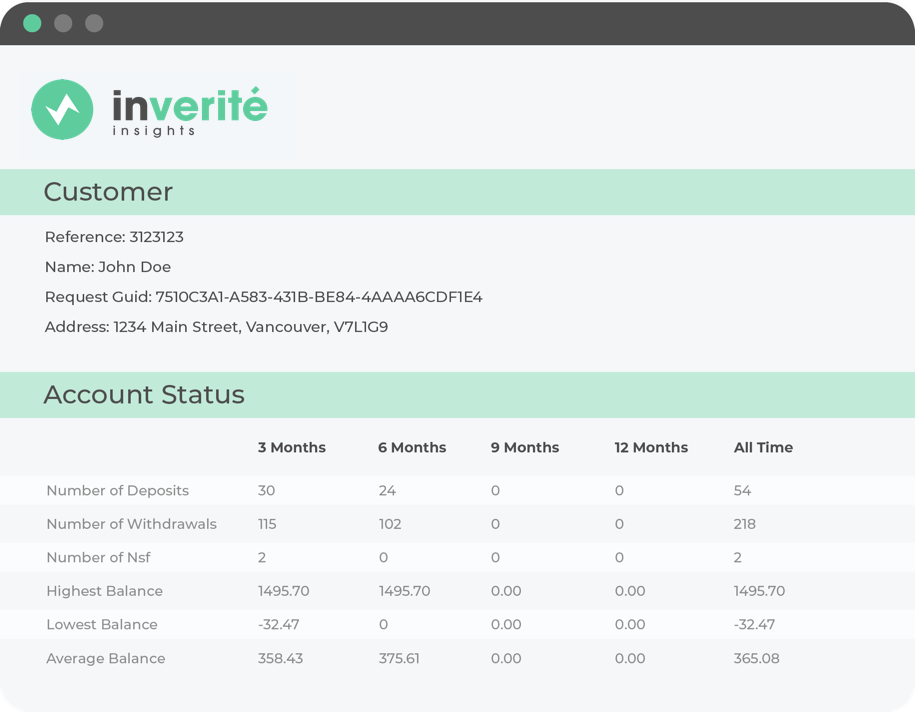

We offer different risk models to match the different conditions of your industry. For the ultimate performance, we can build a custom risk model that, in addition to banking data, also uses customer profile information and past customer repayment history to further enhance algorithms.

Features

Machine learning-powered algorithms leverage insights from over one million banking reports.

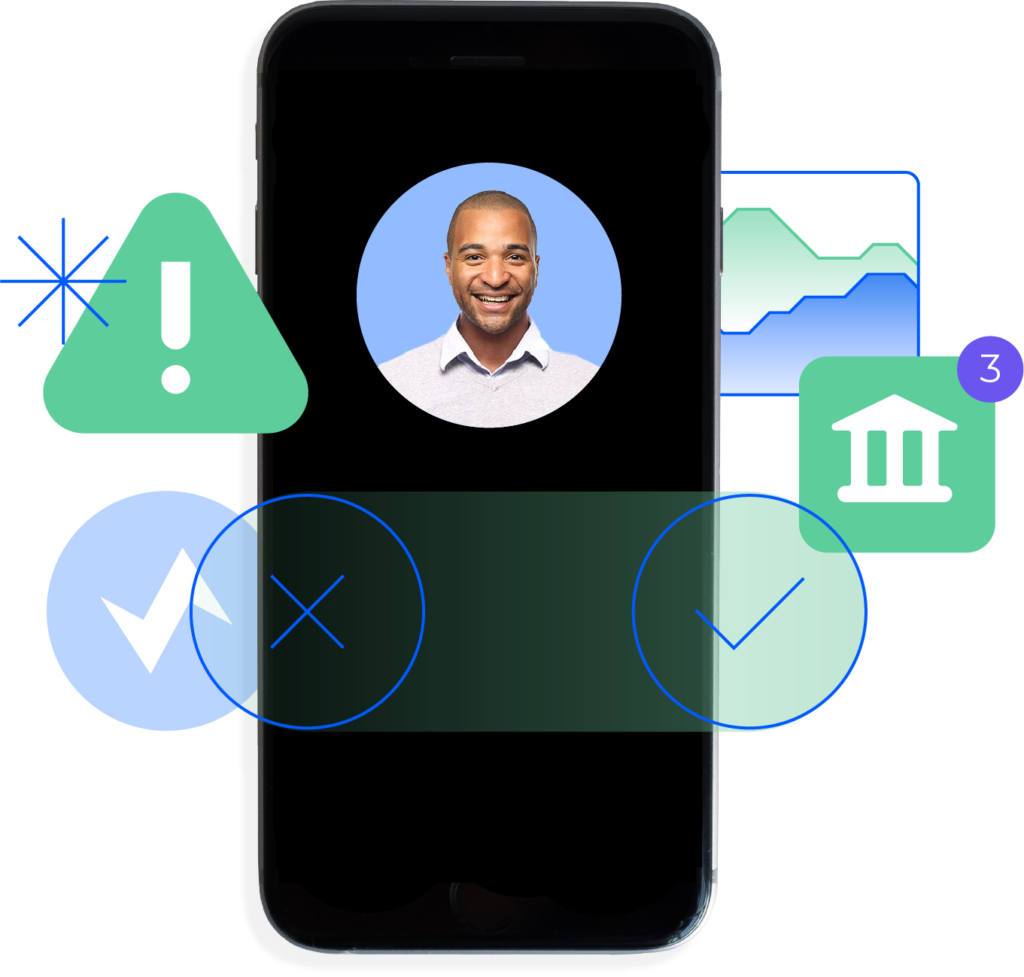

- At-a-glance applicant summary information including income type, income amount, income frequency, and upcoming payroll date predictions.

Trained custom models tailored specifically to your business.

Benefits

Ensures accurate and data-driven decisions for your business by enabling statistical predictions based on millions of transactions and profile data.

Simplify your underwriting to make faster and more informed lending decisions.

Mitigate fraud risk to prevent future losses and adverse events.

Reduce Costs While Improving Accuracy

We understand that acquisition costs can be a lender’s greatest expense. Our technology stack allows us to deliver our service at a cost significantly lower than the competition. There are no setup fees, monthly minimums or pre-purchase of credits and no long term commitments.