We are very proud of the actions our clients are taking to help consumers during these challenging times. We’ve heard from some who are lending to returning consumers even after a job loss to help them until government programs can take effect. Other clients are using our service to provide loan payment deferrals to their customers who have lost their jobs and are now on income assistance and unable to make payments. If your company is taking steps like these please contact us and see how we can help.

Data Tools – New Reports and Statistics

At the request of several clients we’ve created new reporting views that will make changes in employment and income type more obvious. There is a new PDF report that focuses on income and both web views now show relative employment and government income broken down by month over the reporting period. These numbers are also now available in our API in statistics / employer_monthly_income and government_monthly_income.

We’ve also added the business sector API described in last week’s update to the merchant area for more convenient access, which is available now.

Analytics

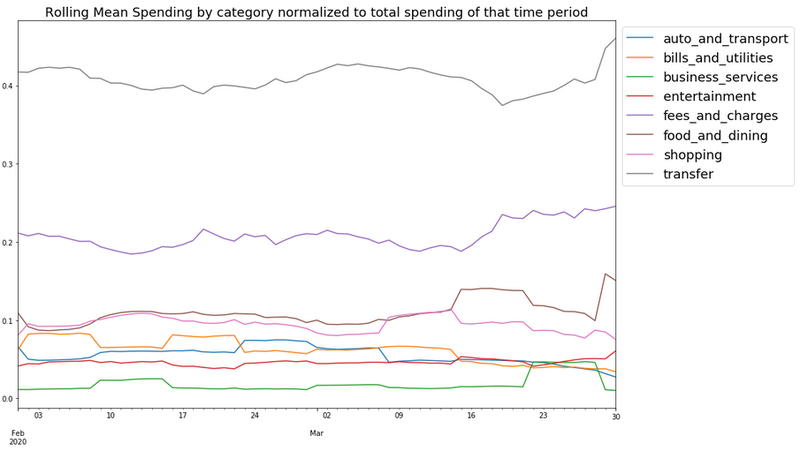

Looking at the transactional data available through the end of March largely confirms what we already suspected. Consumer spending is down almost across the board, particularly on non-essentials like travel, health and fitness and shopping while everyone waits to see what happens next.

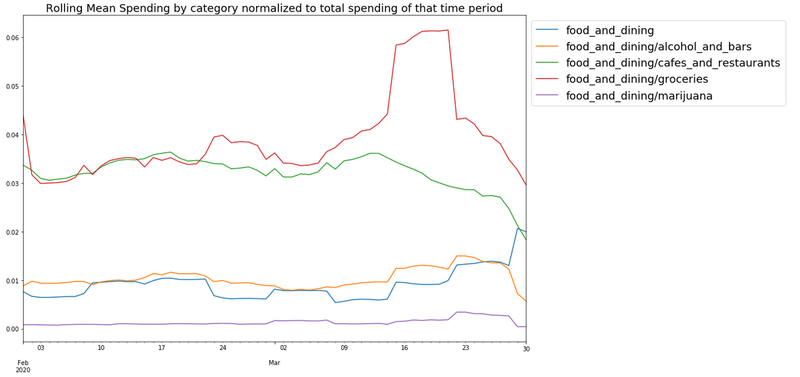

Spending at restaurants is down considerably, while spending on groceries saw a very large spike but that is now subsiding. Lending is down across all segments, although some areas like auto are down more than payday and micro-loans.

We’re already begun seeing an increase in government income relative to employer income and expect this trend to continue. As the monthly cycle repeats we’ll be keeping a close eye on this and the newly launched government program as well as returns and NSF’s from this past cycle.

If you have any questions or ideas on useful analytics, please get in touch with us at [email protected].