Data Tools

Since our last update we have been hard at work, focused on improvements to two of our existing services: Risk Score and ID Verify.

Risk Score

This week we are excited to announce an all-new machine-learning model for our Risk Score service. Several new data sources have been added to the data-layers integrated into our categorization engine which will offer significant improvements to the most critical area of the Risk Score. These sources will be updated continuously automatically to ensure the latest and most accurate data is always available.

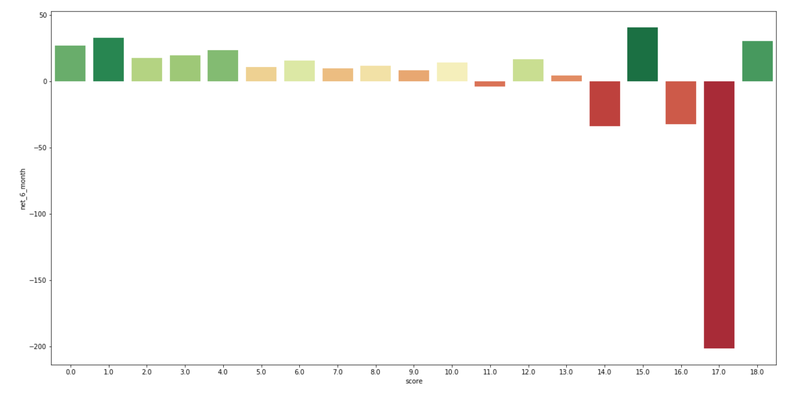

For comparison, we have loan performance by score first on the old model:

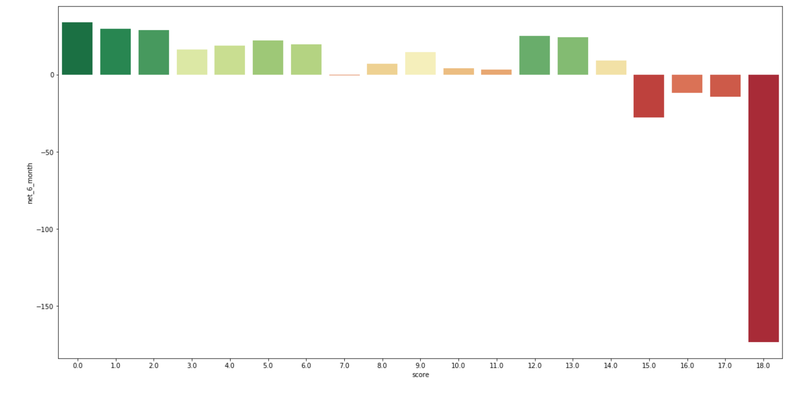

And on the new model.

You can clearly see a significant change in performance at the various score levels which will translate directly to your loan portfolio’s performance.

We are also continuously training the new model as we receive feedback from participating lenders on loans originating since the beginning of the COVID-19 crisis.

ID Verification

We’ve also seen a big increase in usage of our ID Verify tools by our lending clients for an additional layer of KYC. Given that lenders are in uncharted territory, many lenders are choosing to leverage this service to reduce exposure to traditional forms of fraud in their efforts to increase overall efficiency.

Analytics

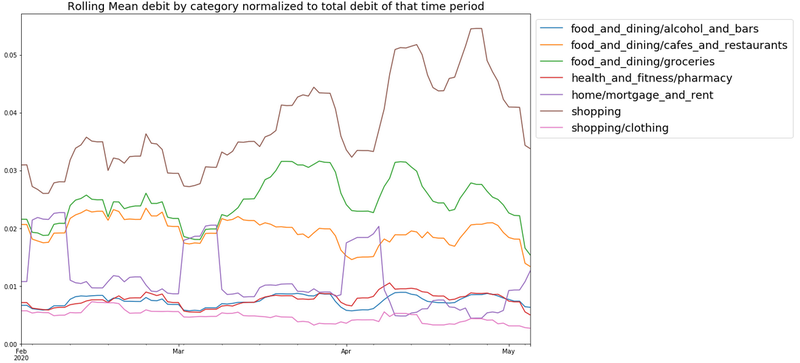

As we enter May we are seeing another shift in spending habits. The big increase we saw in spending on groceries and e-commerce during the second half of March and April is now subsiding. We also see a big drop in mortgage and rent payments for the beginning of May as more customers are choosing to defer mortgage payments.

Now that provinces are preparing to ease restrictions we are cautiously optimistic to see what happens next with consumer spending – we have already seen an modest uptick in new loan applications.

As always, if you have any questions or ideas on helpful analytics, please get in touch with us at [email protected].