Categorization

This week we released the 4th major version of our transaction categorization engine, already the most accurate in Canada. With this release we’ve added 6 new data sources, further increasing the accuracy of our categorizations.

We have also added new sub-categories including separating stop payment, nsf and overdraft fees, and transfers are separated into atm, credit card, email and wire. We’ve added categories for collection agencies, high cost (non payday) loans and pawn shops and there is also now a separate pension category.

These have already been in use by our Risk Score service and we have seen a significant increase in performance, and can be leveraged just as effectively in your own risk modelling and score-cards. Contact us if you wish to have your existing requests re-categorized.

Analytics

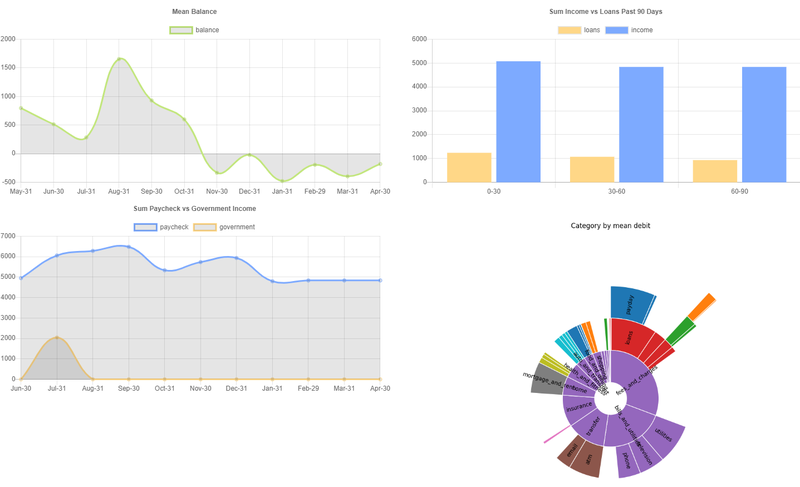

We have updated how our Insights statistics are represented in the Dashboard view with a combination of table and chart based representations to help better understand your customers financial health.

And as always, if you have any questions or ideas on helpful tools and analytics, please get in touch with us at [email protected].