Features

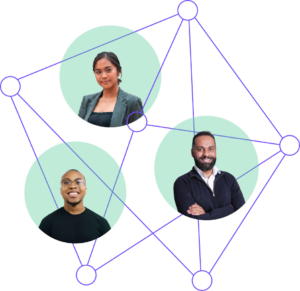

Pull transactional data from multiple data sources

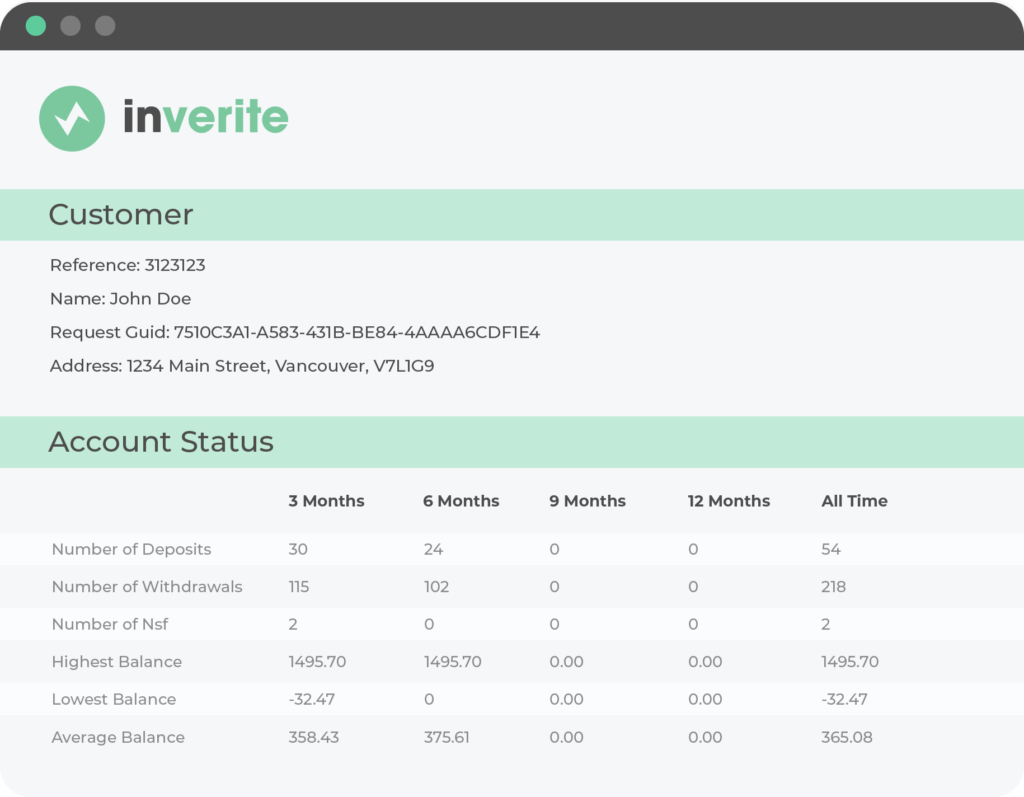

Turn raw data into actionable insights

Build custom analytics frameworks using relevant data

Data Enrichment Use cases

Reduce Costs While Improving Accuracy

We understand that acquisition costs can be a lender’s greatest expense. Our technology stack allows us to deliver our service at a cost significantly lower than the competition. There are no setup fees, monthly minimums or pre-purchase of credits and no long term commitments.