How does Inverite compare to MX?

Inverite stands with accurate, enriched data, and tailored a risk score to unlock invaluable opportunities to grow your business and increase customer satisfaction. Our categorized and simplified transaction data that is highly accurate and easy to use helps improve the customer journey and digital experience, while improving operational efficiencies.

| Widest coverage to financial institutions in Canada | 280+ | |

| Included Enhanced Categorization | ||

| Customized Decision Score | ||

| Support for Neo banks | ||

| Risk Model as a Service | ||

| Implied consumer coverage | ||

| ID Verification | ||

| Pricing |

Economical pricing

Inverite’s pricing structure ensures accessibility for businesses of all sizes, with multiple tiers ranging from small business to enterprise-level solutions. In contrast, competitor pricing models are based on the number of users, which may result in higher costs for businesses. With Inverite, you can access top-tier financial data services at a more affordable rate than our competitors.

Superior support model

We pride ourselves on our superior support model, designed to ensure our merchants receive the assistance they need when they need it most. Our unparalleled responsiveness to bank changes is what sets us apart with the fastest response times in the industry. For example, when TD introduced MFA, we resolved the issue within 1.5 hours, a feat that took competitors approximately 6 hours.

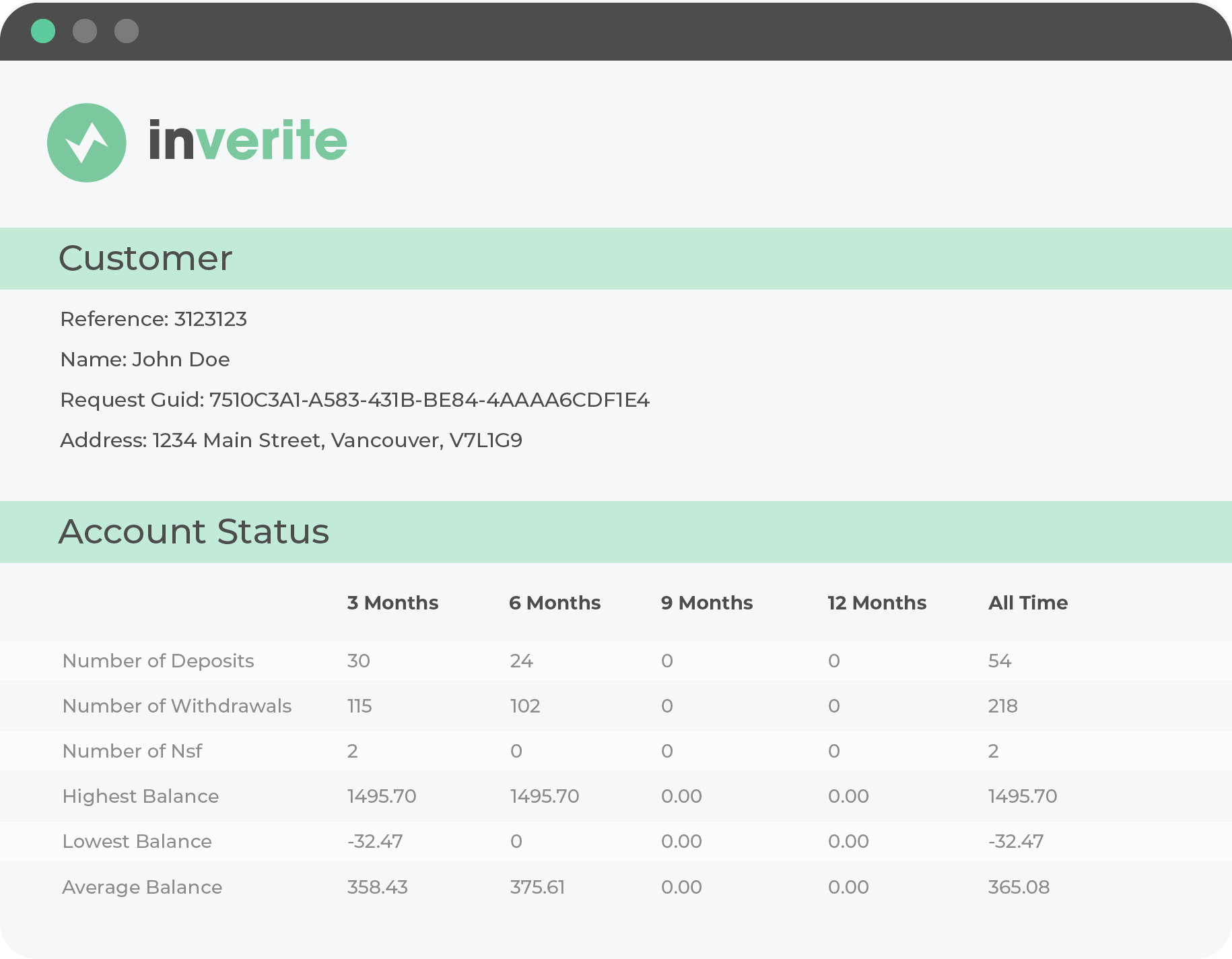

Enhanced data insights

Our Data Enrichment tool offers capabilities to address data gaps, reduce fraud, and enhance client experiences across retail and wealth management applications. While our competitors provide data services, our comprehensive enrichment solutions deliver deeper insights and greater value for businesses. With Inverite, you can maximize enriched financial data to drive informed decision-making and accelerate growth.

Applications in action.

I’m interested, but I have a few questions…

What if our team is already using MX?

If your team is already using another service, we invite you to explore how Inverite can provide added value over your current solution. Our team is ready to help with a seamless transition and answer any specific questions about integrating Inverite into your existing workflow.

Can Inverite integrate with the systems we currently use?

Yes, Inverite seamlessly integrates with your existing systems through three primary methods tailored to different needs: the Bank iFrame for simple dashboard use, the Bank API for integration with Loan or Customer Management Systems, and the Advanced Bank API for full control over the user experience in mobile apps.

Is Inverite safe for my customers?

Absolutely. The security of your customers’ data is our top priority. We take every measure to ensure that their information remains protected at all times. Inverite is proud to be Multi-Factor Authentication (MFA) and SOC II Type 1 compliant. This means that we adhere to the highest standards of security protocols and practices, providing peace of mind to both our merchants and their customers.

Robust verification-solutions.

Real-time bank, ID, and Risk Scoring through open banking APIs.