The Challenge:

Ensuring Trust in Financial Transactions

In today’s digital landscape, ensuring that the individual, or customer, you are servicing is indeed the account holder is critical. Fraud prevention is a top priority, especially for businesses required to comply with know-your-customer (KYC) and FINTRAC regulations. Without accurate identity verification, companies face increased risks, including fraud and data breaches, which can severely impact their operations and reputation.

The Solution:

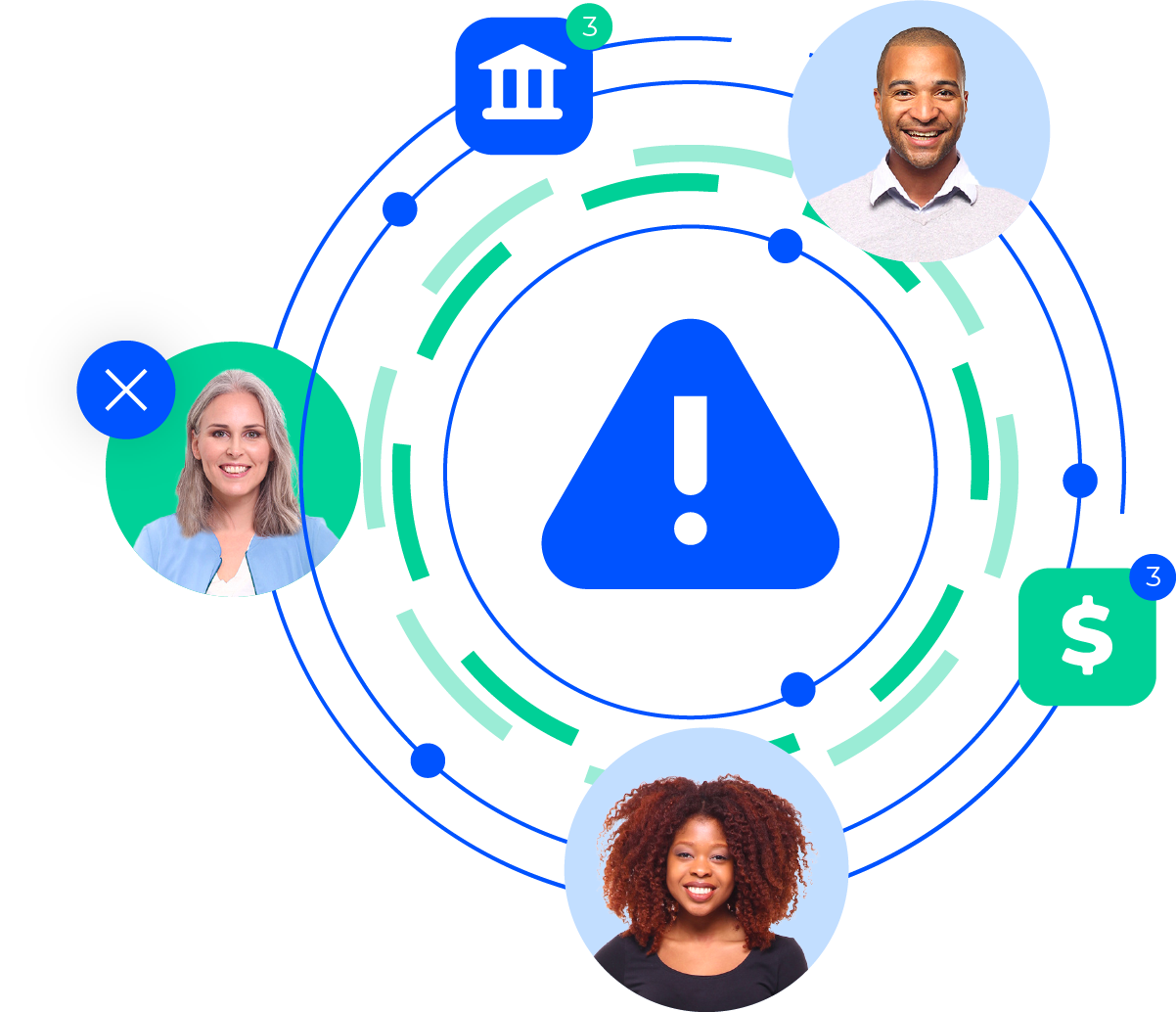

Inverite Bank Verification Name Match

Our Bank Verification Name Match feature is specifically designed to validate and compare customer names against the names stored within a bank’s database. By adding this extra layer of security, our solution helps businesses meet KYC and FINTRAC requirements with the Dual Method, ensuring that the person conducting the transaction is the legitimate account holder. This feature enhances fraud prevention measures, instills confidence in your customers, and protects your business from potential risks.

Use Cases

Features

Transaction history from 275+ Canadian Banks and Credit Unions

Flexible reporting length up to 365 days

Transaction categories and summaries

Complimentary 30-day account refreshes

Full Account, Transit and Institution numbers from 40+ Canadian Financial Institutions

Account Owner Name, Address & Contact information

Chequing, Savings and Credit Card accounts

Four distinct API’s to meet your exact integration requirements

Zero-integration options including standalone portal and hosted landing pages

Multilingual support for English, French and Spanish

Dedicated support staff for helping your customers by phone and email

Built around PCI Data Security Standard 3.2.1 to keep your data safe