This month’s product feature: Risk ScoreRisk management can be the key to decreasing avoidable costs and sustaining healthy growth for a business and loan portfolio. One size doesn’t fit all isn’t effective when it comes to a risk management strategy. |

|

|

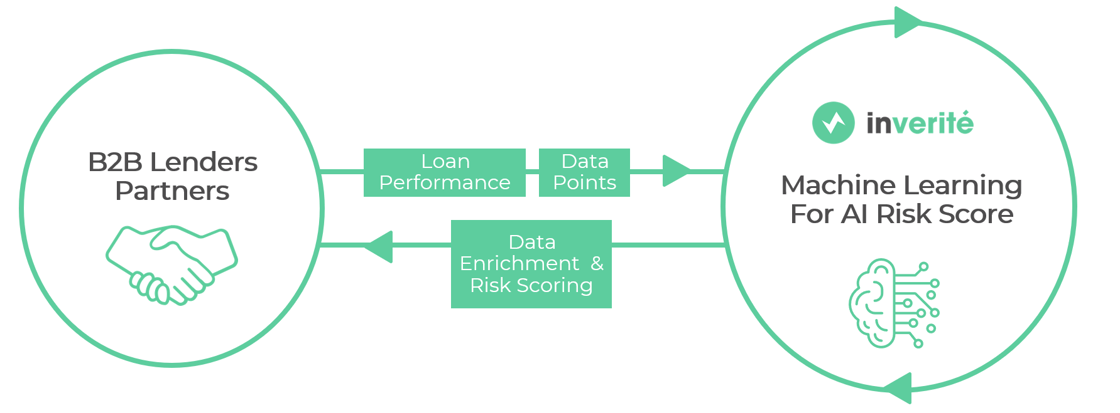

Reduce defaults, save on feesRisk Score leverages machine-learning powered algorithms that are built on data from over one million unique consumer banking reports and layered with loan performance data to extract valuable insights and patterns and provide you with a customer’s Risk Score. 1 Million unique Customers’ bank reports + 7 Billion data Points + loan performance data = Risk Score |

|

|

These algorithms employ techniques to analyze large volumes of data, identifying trends, correlations, and anomalies to actual loan performance that might not be immediately apparent. The Risk Score is available as an out-of-box solution and can be customized based on your company’s loan performance data used to develop a customized Precision Risk Score.

Identifying high-risk customers early is not just a strategic move, but a cost-saving one. You can significantly reduce the likelihood of default fees by preemptively catching and addressing any potential risks that come with these profiles and create operational efficiencies by reducing the time to adjudicate an application.

As the saying goes, time is currency, and processing efficiency is a critical factor in this field. Risk Score is made to cut down on processing time, which enables you to make faster, more informed decisions. |

Simple API integrationRisk Score is accessible both through your portal and via API. For comprehensive instructions on integrating this robust tool into your system, please refer to our documentation page.Benefit from using Risk Score for your operations

When integrated with other verification tools such as Instant Bank Verification and ID Verification, Risk Score can be a powerful toolset for optimizing underwriting accuracy and reducing the risk of fraud. To learn more about implementing Risk Score or to discuss your unique needs, schedule a quick chat with our team through our website, or by reaching out to your account manager. |

|

|

Inverite PaymentsThe growing interest and demand in open banking and new payment technologies suggests account-to-account payments could soon be the preferred way for people and businesses to pay and get paid. |

|

|

A2A payments fundamentally involve moving money directly from one account to another without needing middlemen like card networks. This process is supported by banks, payment processors, and fintech companies, ensuring it’s safe and follows the rules. |

|

With Inverite Payments, you can

We’re currently exploring the integration of account-to-account (A2A) payments to streamline your repayment process. We’d love to hear from you—please take a moment to share a bit about your company and your thoughts on this potential enhancement |

|

|

Get in touchWhether you’re encountering specific challenges or just eager to optimize your risk strategies, we’re here to help. |